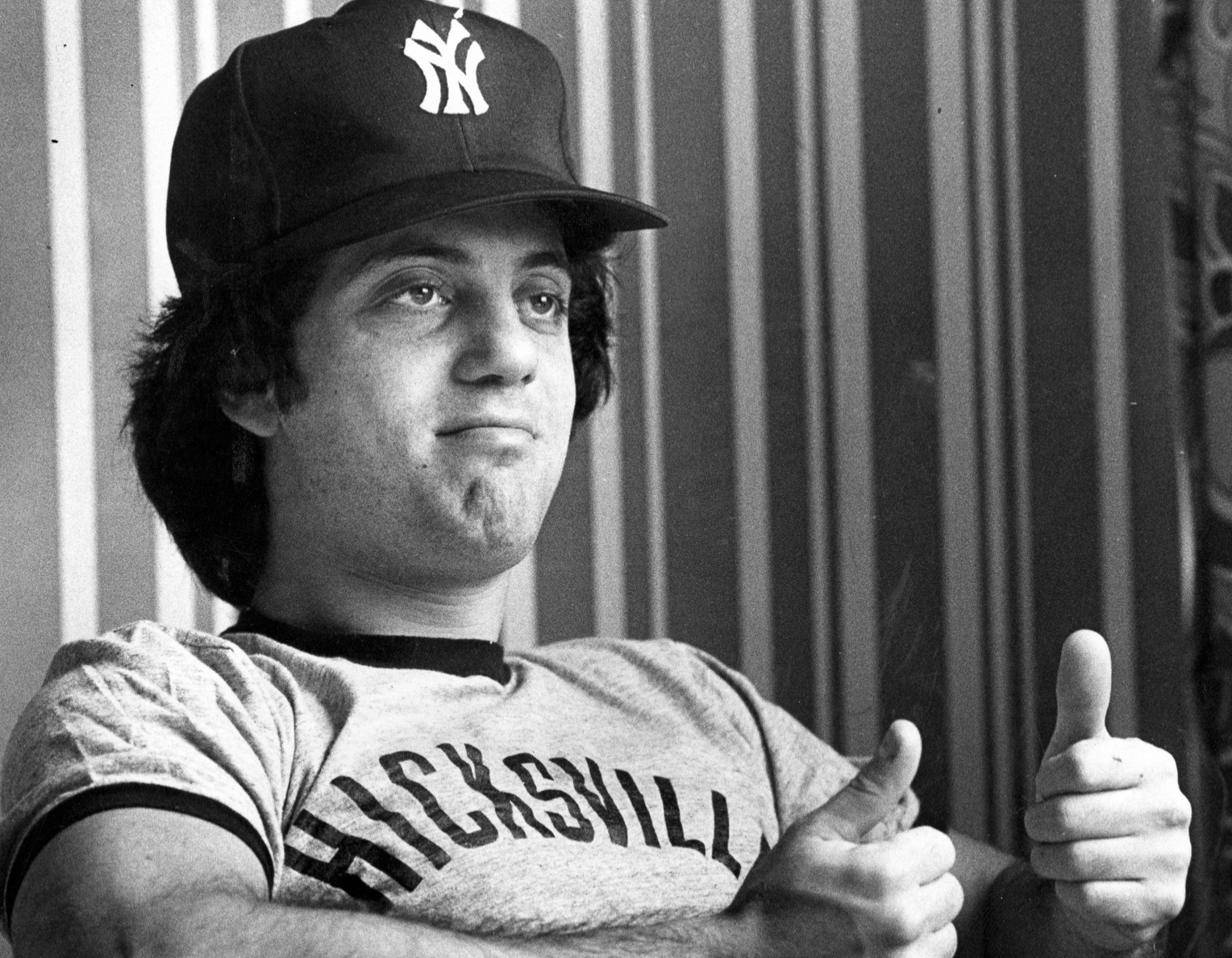

Still Rock and Roll to me

I’ve already mentioned in my prior post “The Greatest Recession” the importance of Richard Koo’s work on the balance sheet recession. Indeed, we are lucky to have this guide as we recognize the consequence, significance, and inevitable results of putting our fiscal laxity into hyperdrive. This post is not intended to harbinger gloom and pessimism, the world will continue regardless, but these are obvious vulnerabilities that did not have to metastasize – and they ought […]